The Man, The Myth, The Annual Paycheck

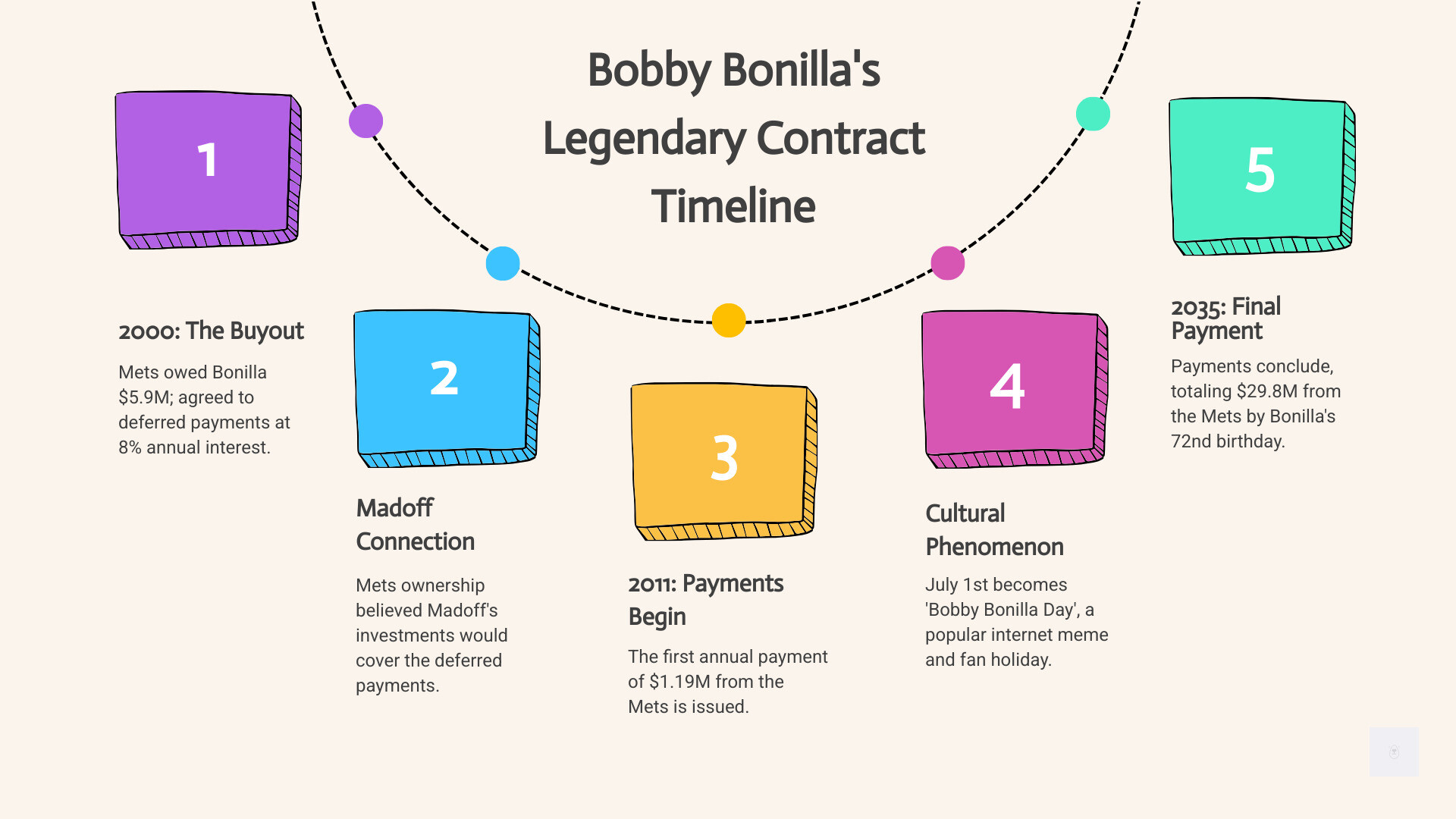

Bobby Bonilla may have retired from Major League Baseball over two decades ago, but every July 1st, he receives a check that makes him the envy of sports fans everywhere. Here’s what you need to know about this legendary financial arrangement:

Quick Facts:

- Annual Payment: $1,193,248.20 from the New York Mets

- Duration: 2011-2035 (25 years total)

- Original Amount Owed: $5.9 million in 2000

- Total Payout: $29.8 million

- Interest Rate: 8% annually

- Age When Payments End: 72 years old

The story of Bobby Bonilla’s deferred contract has become more famous than his 16-season playing career. Born February 23, 1963, in the Bronx, this six-time All-Star and World Series champion negotiated what many consider the luckiest contract in sports history.

While most people know July 1st as the midpoint of summer, baseball fans have dubbed it “Bobby Bonilla Day” – a tongue-in-cheek holiday celebrating the annual payday that turned a routine contract buyout into a cultural phenomenon. The deal’s origins trace back to 2000, when the Mets wanted to release an underperforming Bonilla but agreed to defer his remaining salary with interest.

What makes this story particularly fascinating is its connection to Bernie Madoff’s Ponzi scheme. Mets owner Fred Wilpon believed his investments with Madoff would easily outpace the 8% interest rate, making the deferred deal seem like a smart financial move. Instead, it became a cautionary tale about overconfidence in guaranteed returns.

As R. Couri Hay, I’ve witnessed countless high-society financial arrangements and celebrity contracts throughout my four decades in public relations and media commentary. The Bobby Bonilla saga exemplifies how strategic negotiation – much like the brand development work I’ve done for cultural institutions – can create lasting legacies that transcend their original intent.

Simple guide to * bobby bonilla*:

- celebrity lifestyle insights

- kai cenat net worth

- Hollywood Gossip

The All-Star Player Before the Legendary Payday

Long before Bobby Bonilla became synonymous with annual July 1st celebrations, he was making headlines for his impressive skills on the baseball field. When he made his MLB debut on April 9, 1986, at just 23 years old, few could have predicted that his financial savvy would eventually overshadow his athletic achievements.

Bobby Bonilla carved out a remarkable 16-season career as a versatile player who could handle multiple positions. Whether he was manning third base, patrolling right field, or covering first base when needed, Bonilla brought consistent excellence to every role. His ability as a switch-hitter made him particularly valuable – he could deliver powerful hits from both sides of the plate, keeping opposing pitchers constantly guessing.

The Pittsburgh years were where Bonilla truly shined. Playing alongside Barry Bonds, the duo became known as the “Killer B’s” – a nickname that struck fear into opposing teams throughout the late 1980s and early 1990s. This dynamic partnership showcased Bonilla’s ability to perform under pressure while contributing to a winning culture.

His talent didn’t go unnoticed. Bobby Bonilla earned recognition as a 6-time All-Star (1988-1991, 1993, 1995) and received 3 Silver Slugger Awards (1988, 1990, 1991). These honors reflected his consistent offensive production and clutch hitting ability that made him one of the premier players of his era.

By the time he hung up his cleats on October 7, 2001, Bonilla had accumulated 2,010 career hits, 287 home runs, and maintained a solid .279 batting average. Perhaps most importantly, he achieved every player’s ultimate goal by winning the 1997 World Series with the Florida Marlins – proving his value as a championship-caliber player even in the later stages of his career.

A Look at the Teams Bobby Bonilla Played For

Bobby Bonilla’s journey through Major League Baseball reads like a tour of America’s baseball cities. His career began with the Chicago White Sox in 1986, but it was his move to the Pittsburgh Pirates that same year where he truly found his footing.

The Pirates years (1986-1991) were his golden era, where he formed that legendary partnership with Barry Bonds and earned most of his individual accolades. His first stint with the New York Mets (1992-1995) made him the highest-paid player in baseball, while his time with the Baltimore Orioles (1995-1996) set up another significant deferred contract that often gets overlooked.

The Florida Marlins (1997-1998) gave him that coveted World Series ring, while brief stops with the Los Angeles Dodgers (1998), Atlanta Braves (2000), and St. Louis Cardinals (2001) rounded out his career. His return to the Mets in 1999 would ultimately lead to the famous contract buyout that created “Bobby Bonilla Day.”

Throughout these eight different uniforms, Bonilla consistently delivered solid offensive production, proving his worth to every organization that invested in his services. For those interested in diving deeper into his statistical achievements, you can find more about his career from SABR.

Bobby Bonilla and His Relationship with the New York Media

When Bobby Bonilla signed his groundbreaking five-year, $29 million contract with the New York Mets in 1992, he became the highest-paid player in baseball history. With great paychecks come great expectations – especially in the pressure cooker that is New York sports media.

At his introductory press conference, Bonilla delivered a line that would become legendary: “I know you all are gonna try, but you’re not gonna be able to wipe the smile off my face.” It was vintage Bonilla – confident, charismatic, and completely unaware of how prophetic those words would become decades later when he’d be smiling all the way to the bank every July 1st.

The reality of playing under such intense scrutiny proved challenging. Stories emerged of Bonilla calling the press box during games to dispute scoring decisions, showing how the constant media attention affected even routine aspects of his performance. The clubhouse dynamic became strained as expectations mounted and results didn’t always match the hefty price tag.

The most infamous incident occurred during the 1999 NLCS elimination game, when Bobby Bonilla and Rickey Henderson were reportedly playing cards in the clubhouse while their team was being eliminated. Whether this story was exaggerated or not, it became symbolic of the disconnect between Bonilla’s laid-back personality and the win-at-all-costs mentality that New York fans demanded.

In my years covering high-profile personalities and their public personas, I’ve seen how crucial effective branding becomes when someone carries the weight of being “the highest-paid” anything. The pressure to constantly justify that investment can create tensions that extend far beyond the playing field – a lesson that applies whether you’re in baseball or any other high-stakes industry.

The Anatomy of the Infamous Bobby Bonilla Contract

The Bobby Bonilla contract story reads like something out of a financial thriller. Picture this: it’s 2000, and the New York Mets want to cut ties with an underperforming player who’s owed $5.9 million. Instead of writing a check and moving on, they agreed to one of the most talked-about deals in sports history.

Working with his agent Dennis Gilbert, Bobby Bonilla negotiated what can only be described as a financial masterstroke. Rather than taking the $5.9 million upfront, he agreed to defer the payment with an 8% annual interest rate. This seemingly simple arrangement transformed his buyout into 25 annual payments of $1,193,248.20, starting in 2011 and continuing through 2035.

Gilbert, a former insurance salesman who understood the power of compound interest, helped structure a deal that would provide Bonilla with long-term financial security well into his golden years. It’s a perfect example of how Effective strategic planning can turn what seems like a routine transaction into a generational wealth-building opportunity.

The math is staggering. That original $5.9 million debt will ultimately cost the Mets nearly $30 million by the time the final payment is made. For Bobby Bonilla, it meant changing a single payday into a guaranteed income stream that would last 25 years.

The Bernie Madoff Connection: A Deal Too Good to Be True

Here’s where the story takes a dark turn that would make even the most seasoned Wall Street observer wince. The Mets didn’t agree to this deal out of generosity – they thought they were pulling off their own financial coup.

Fred Wilpon, the Mets’ co-owner, was heavily invested with Bernie Madoff, the infamous financier who was running what would become the largest Ponzi scheme in history. Wilpon believed he was earning consistent returns of 10-13% through Madoff’s investment fund. With those kinds of “guaranteed” returns, paying Bobby Bonilla 8% interest seemed like easy money.

The plan was brilliant in its simplicity: keep the $5.9 million, invest it with Madoff, pocket the difference between the 8% they owed Bonilla and the double-digit returns they expected from Madoff. It looked like a win-win situation that would make the Mets organization millions.

Then December 2008 arrived, and Madoff’s house of cards came crashing down. The supposed investment genius was revealed as a fraud, and his Ponzi scheme collapsed, taking billions of dollars with it. Wilpon and his partners reportedly lost hundreds of millions, and the Mets found themselves in serious financial trouble.

Suddenly, that clever Bobby Bonilla deal looked very different. Instead of a smart financial move, it became an annual reminder of the organization’s poor judgment and a costly lesson in crisis management. Every July 1st became a public relations nightmare, with fans and media pointing to Bonilla’s payment as a symbol of the team’s financial mismanagement.

It’s Not Just the Mets: The Other Deferred Deal

Most people don’t realize that Bobby Bonilla pulled off this deferred payment magic trick twice. His lesser-known but equally impressive second act involves the Baltimore Orioles, proving that his first deal wasn’t just beginner’s luck.

After his time with the Orioles, Bonilla negotiated another deferred compensation package. This one pays him $500,000 annually from 2004 through 2028 – a 25-year commitment that quietly adds another $12.5 million to his retirement fund.

This Baltimore deal demonstrates that Bobby Bonilla and his representatives understood something that many athletes miss: the power of guaranteed future income. While his peers were spending their earnings immediately, Bonilla was building a financial foundation that would support him for decades after his final at-bat.

The Orioles’ agreement might not generate the same headlines as the Mets’ deal, but it’s arguably even more impressive from a financial planning perspective. It shows that the concept of deferred compensation wasn’t just a one-time stroke of luck – it was a deliberate strategy that Bonilla employed multiple times throughout his career.

The Legacy: How a Contract Became a Cultural Phenomenon

The Bobby Bonilla deferred contract has grown far beyond a simple financial arrangement to become something truly special in sports culture. Every July 1st, something magical happens across social media – fans everywhere celebrate with memes, jokes, and genuine congratulations for what’s now universally known as “Bobby Bonilla Day.”

What makes this phenomenon so endearing is how it brings people together. Sports talk radio hosts mark their calendars for it. Twitter explodes with creative posts. Even casual baseball fans who might not know Bonilla’s career stats can tell you exactly when he gets his annual check.

The new Mets owner, Steve Cohen, has acceptd the tradition with remarkable good humor. Rather than treating it as an embarrassing reminder of past mistakes, he’s joked about holding celebrations at Citi Field complete with an oversized check presentation. This acceptance by the team itself has transformed what could have been a source of frustration into a beloved piece of sports folklore.

Beyond the laughs and memes, “Bobby Bonilla Day” serves as an unexpected teacher. It’s become a masterclass in financial literacy, showing millions of people the real power of compound interest and smart contract negotiation. Many fans use this day to discuss investment strategies, retirement planning, and the importance of thinking long-term about money.

The story also highlights Bobby Bonilla‘s character beyond baseball. In 1992, he and his wife Millie established the Bobby and Millie Bonilla Public School Fund, contributing $35,000 to support educational initiatives in his hometown. This philanthropic spirit adds depth to a man who’s often reduced to just his famous contract.

The “Bobby Bonilla Day” Effect on Modern Contracts

While Bobby Bonilla‘s deal captures the most attention, it’s actually part of a much larger trend in professional sports contracts. Deferred compensation wasn’t new when Bonilla negotiated his deal, but his story certainly made everyone pay attention to how these arrangements work.

Several other major league players have structured significant deferred deals over the years. Ken Griffey Jr. has money coming from the Cincinnati Reds until 2024. Max Scherzer negotiated deferrals in multiple contracts throughout his career. These arrangements show how players and teams can creatively structure deals to benefit both sides.

The most stunning modern example is Shohei Ohtani‘s groundbreaking $700 million contract with the Los Angeles Dodgers. In a move that would make Bobby Bonilla proud, Ohtani deferred an incredible $680 million of that deal. He’ll receive just $2 million annually while playing, with the bulk of his salary paid out between 2034 and 2043.

This massive deferral gives the Dodgers significant advantages with luxury tax implications, allowing them much more flexibility in building their roster. It demonstrates how teams now view deferred payments not just as buyout tools, but as strategic weapons for payroll management and competitive balance.

The lasting influence of Bobby Bonilla‘s “luckiest contract” continues to shape how players, agents, and teams approach negotiations. What started as a unique solution to a specific problem has become a blueprint that’s still being used decades later, proving that sometimes the most memorable deals are the ones that keep on giving.

Frequently Asked Questions about Bobby Bonilla

The Bobby Bonilla contract story raises so many questions that it’s become one of the most discussed financial arrangements in sports history. After covering high-society deals and celebrity contracts for decades, I’ve found that the most fascinating stories often come from the questions people ask most frequently.

Why do the Mets still pay Bobby Bonilla?

The simple answer lies in a 2000 contract negotiation that seemed brilliant at the time. When the Mets wanted to part ways with Bobby Bonilla, they owed him $5.9 million for the upcoming season. Rather than cutting a check and moving on, both sides agreed to something more creative.

The team chose to defer that payment with an 8% annual interest rate. This transformed the original $5.9 million into 25 annual payments of $1.19 million, stretching from 2011 to 2035. For the Mets, it freed up immediate cash flow. For Bobby Bonilla, it guaranteed decades of financial security.

The real kicker? Mets ownership believed their investments with Bernie Madoff would easily generate returns above that 8% rate. They thought they were getting the better end of the deal. History, of course, had other plans.

How much money will Bobby Bonilla receive in total?

The numbers are staggering when you add them up. From the New York Mets alone, Bobby Bonilla will collect a total of $29.8 million by the time his final payment arrives in 2035. That’s turning $5.9 million into nearly $30 million through the magic of compound interest.

But here’s what many people don’t realize – the Mets aren’t his only source of deferred income. The Baltimore Orioles also structured a separate deal that pays him $500,000 annually. That arrangement will total $12.5 million by its conclusion in 2028.

Combined, these two deferred contracts will have paid Bobby Bonilla over $42 million for work he completed decades ago. It’s a retirement plan that most people can only dream about.

When does Bobby Bonilla Day end?

Mark your calendars for July 1, 2035 – that’s when the final payment from the New York Mets will arrive. Bobby Bonilla will be 72 years old when he receives his last $1.19 million check, officially ending one of the most famous financial arrangements in sports history.

The Baltimore Orioles payments will actually wrap up earlier, concluding in 2028. So while the internet holiday we know as “Bobby Bonilla Day” will continue for another decade-plus, his total deferred compensation story will be complete by 2035.

It’s worth noting that Bobby Bonilla will have been receiving these payments for 24 years by the time they end – longer than his actual playing career lasted. Now that’s what I call a lasting legacy.

Conclusion: An Unforgettable Legacy in Sports History

The Bobby Bonilla story is one of those rare tales that perfectly captures the intersection of sports, money, and pure human ingenuity. What started as a routine contract buyout has evolved into something much more significant – a masterclass in financial acumen that continues to fascinate fans and financial experts alike.

Every July 1st, when that $1.19 million check arrives in Bonilla’s mailbox, it serves as a reminder that sometimes the most unconventional decisions yield the most extraordinary results. His deferred contract has become genuine sports folklore, turning a former All-Star into a cultural icon whose fame now extends far beyond his playing days.

The irony isn’t lost on anyone familiar with the story. What the Mets intended as a clever financial maneuver – leveraging their Madoff investments to cover the deferred payments – became a cautionary tale about the dangers of overconfidence in guaranteed returns. Meanwhile, Bobby Bonilla emerged as the victor in this financial chess match, demonstrating the power of savvy negotiation and long-term thinking.

His legacy transcends baseball statistics and contract details. It’s become a symbol of how understanding the fine print and thinking beyond the immediate can create lasting financial security. The fact that “Bobby Bonilla Day” has become an internet holiday speaks to our collective fascination with stories where the underdog – or in this case, the retired player – comes out ahead.

As someone who has spent decades observing the intricate dance between celebrities, money, and public perception, I find the Bobby Bonilla saga particularly compelling. It embodies the kind of insider story that reveals deeper truths about human nature, financial decision-making, and the unpredictable ways our choices can shape our legacies.

This remarkable tale will continue entertaining and educating people long after that final payment in 2035. It’s a perfect example of how life’s most interesting stories often emerge from the most unexpected places. To Explore more insider stories that dig into the fascinating decisions and cultural moments that define our world, join us as we continue uncovering the unique tales that capture our collective imagination.