Why Alaska’s Unique Stimulus Payment Sets It Apart from Federal Programs

The alaska permanent fund dividend stimulus payment is Alaska’s annual $1,702 distribution to qualifying residents – a program that makes the state unique among all U.S. territories. While most Americans haven’t seen federal stimulus checks since the pandemic, Alaskans continue to receive this yearly windfall from their state’s oil wealth.

Key Facts About Alaska’s 2025 PFD Payment:

- Amount: $1,702 per eligible resident

- Components: $1,403.83 dividend + $298.17 energy relief payment

- Recipients: Approximately 600,000 Alaska residents

- Payment Date: August 21, 2025 (for applications in “Eligible-Unpaid” status)

- Funding Source: State oil revenues and investment earnings

- Program History: Operating since 1982, making it one of America’s longest-running direct payment programs

Eligibility Requirements:

- Alaska resident for all of 2024

- Intent to remain an Alaska resident indefinitely

- No felony convictions during the qualifying year

- Maximum 180 days absent from Alaska (with exceptions)

- Must have spent at least 72 consecutive hours in Alaska in 2023 or 2024

From my perspective here in New York City, where we see targeted programs like the STAR property tax relief, Alaska’s universal dividend represents a fascinating model of wealth distribution that other states can only dream about. As R. Couri Hay, having covered economic and social policy stories throughout my four decades in media, I’ve observed how the alaska permanent fund dividend stimulus payment serves as both economic stimulus and a unique experiment in sharing natural resource wealth with citizens.

Related content about alaska permanent fund dividend stimulus payment:

What is the Alaska Permanent Fund Dividend (PFD)?

Picture this: a state that actually gives money back to its residents every single year, not as welfare or targeted relief, but as their rightful share of natural resource wealth. That’s exactly what Alaska has been doing since 1982 with the Alaska Permanent Fund Dividend program.

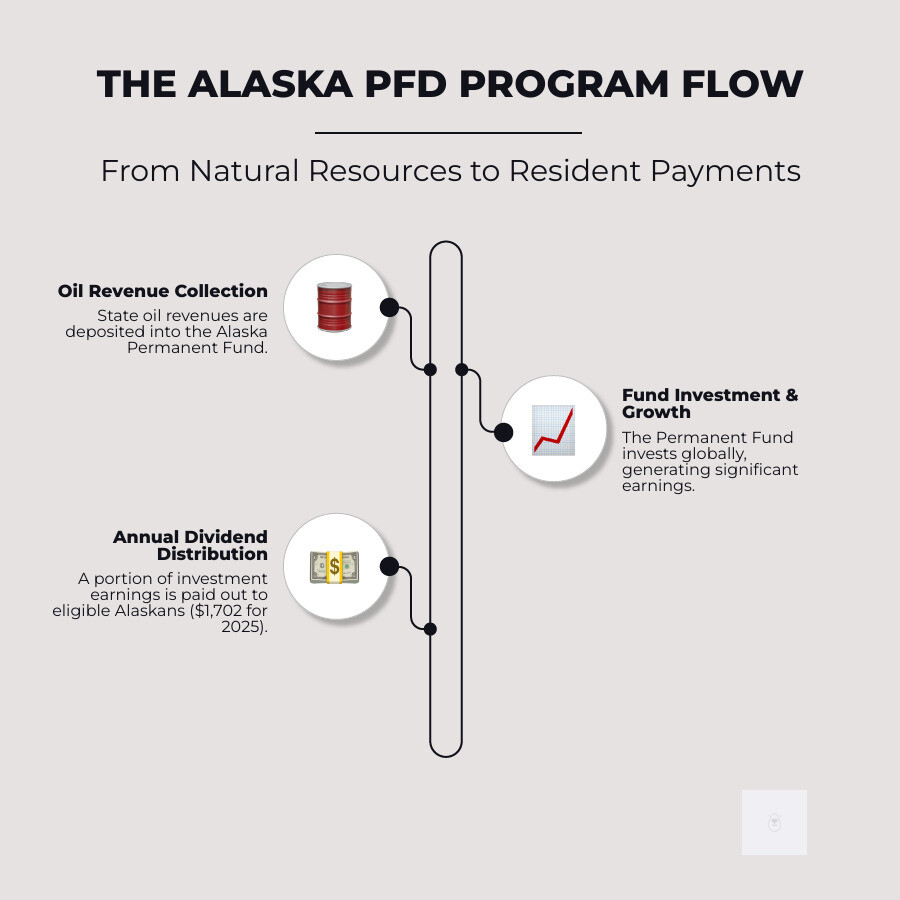

The story begins back in 1976, when Alaskans made a brilliant decision that would set them apart from every other state. They voted to amend their state constitution to create the Alaska Permanent Fund – essentially a massive savings account funded by oil revenues. Instead of politicians spending every penny as it rolled in (which, let’s be honest, is what usually happens), they decided to sock away a portion for the future.

This wasn’t just smart financial planning – it was revolutionary. The Alaska Permanent Fund Corporation (APFC) was established as an independent entity to manage these funds, keeping them separate from the day-to-day political pressures that might tempt lawmakers to raid the piggy bank.

The genius of the system lies in its structure. The fund takes a portion of state oil revenues and invests them in a diversified portfolio – stocks, bonds, real estate, you name it. The alaska permanent fund dividend stimulus payment comes from the earnings on these investments, not the principal itself. This means the fund keeps growing while still providing annual payments to residents.

The first dividend check went out in 1982, and Alaskans have been receiving their annual windfall ever since. From my vantage point here in New York City, where we’re more familiar with targeted tax relief programs, Alaska’s approach seems almost too good to be true.

The Goal: A Dividend for Every Alaskan

The mastermind behind this program was Governor Jay Hammond, who had a simple but powerful vision: every Alaskan should directly benefit from their state’s natural resource wealth. Not just the oil companies, not just the politicians, but every single resident.

Hammond understood that oil wouldn’t last forever, but smart investments could provide long-term savings that would benefit generations. The annual distribution serves multiple purposes – it provides economic stability for residents, acts as a form of universal basic income, and creates a direct connection between citizens and their state’s prosperity.

For many Alaskan families, this yearly payment is a crucial financial boost. Some use it for everyday expenses, others save it for education or retirement. Either way, it provides a predictable annual distribution that helps smooth out the ups and downs of economic life.

How the PFD is Funded

The funding mechanism is neatly simple. When oil companies extract Alaska’s “black gold,” a portion of those state oil revenues flows into the Permanent Fund. Think of it as Alaska’s way of saying, “This oil belongs to all of us, so we should all benefit.”

The Alaska Permanent Fund Corporation then works its magic, investing this money across various asset classes to generate investment earnings. The beauty is that the Permanent Fund principal remains untouched – it’s only the returns on investment that fund the dividends.

Each year, the legislature determines how much money is available for distribution through a specific calculation formula. This legislative appropriation process balances the desire for generous payments with the need to keep the fund healthy for future generations.

It’s a delicate balancing act that has worked remarkably well for over four decades, turning Alaska’s natural resource bounty into a lasting legacy for its residents.

The 2025 Alaska Permanent Fund Dividend Stimulus Payment Explained

Anticipation is truly in the air across Alaska! Residents are eagerly looking forward to the 2025 alaska permanent fund dividend stimulus payment. This annual financial boost is a significant event for individuals and families, providing crucial support and stimulating local economies. From our perspective here in New York, where state support often comes in the form of targeted tax credits, understanding the specifics of this universal payment—from its amount to eligibility and distribution—is a fascinating case study in direct economic support.

How Much is the 2025 Alaska Permanent Fund Dividend Stimulus Payment?

For 2025, eligible Alaska residents are set to receive a total of $1,702 through the PFD program. It’s always exciting to see this number! This amount isn’t just a single lump sum; it’s cleverly put together from two parts. There’s the base dividend from the Permanent Fund earnings, and then, often, an extra payment like an energy relief bonus. For example, the 2024 PFD, which shares the same total amount as what we expect for 2025, broke down to $1,403.83 as the permanent fund dividend portion and a helpful $298.17 for energy relief. We can certainly expect a similar structure for 2025, showing the state’s ongoing commitment to both its long-term dividend program and helping with everyday costs like energy.

To give you a clearer picture, let’s peek at recent years. The 2023 PFD was $1,312. And the 2022 PFD was quite a bit more substantial at $3,284 per eligible Alaskan, which included a larger energy relief payment of $662.19. While the 2025 payment might not reach the heights of 2022, it still represents a truly significant financial injection for around 600,000 residents. That’s a lot of people getting a welcome boost!

Who Qualifies for the Alaska Permanent Fund Dividend Stimulus Payment?

Now, let’s talk about who gets to enjoy this benefit. Eligibility for the PFD is quite specific, ensuring that the payment goes to those who truly call Alaska home. It’s not a free-for-all, and there are clear requirements designed to keep the program fair and strong.

To qualify for and receive the $1,702 payment, you’ll need to meet several key conditions. First off, you must have been an Alaska resident for all of 2024. This means continuous residency throughout the entire calendar year preceding the application year. Think of it as proving you’ve truly settled in. Secondly, you must genuinely intend to remain an Alaska resident indefinitely. This is a big one, as the PFD is for folks who have made Alaska their permanent home, not just a temporary stop.

Third, you can’t have claimed residency or received benefits from another state or country since December 31, 2023. This helps prevent anyone from trying to get benefits from multiple places. Also, a clean legal record is important; applicants must not have any felony convictions during the qualifying year, and shouldn’t have been incarcerated for multiple misdemeanors.

Finally, there are physical presence rules that get a bit detailed. Generally, you can’t have been absent from Alaska for more than 180 days during the qualifying year (2024 for the 2025 payment). But don’t worry, there are justified exceptions for absences, like for studies, health reasons, or military service. Plus, you must have spent at least 72 consecutive hours in Alaska during either 2023 or 2024. Understanding these rules is super important for anyone hoping to receive the alaska permanent fund dividend stimulus payment. For even more detailed information on eligibility, it’s always best to check official sources: To qualify and receive the $1,702 payment, you must meet several key requirements.

PFD Payment Schedule and How to Check Your Status

The distribution of the alaska permanent fund dividend stimulus payment follows a clear, organized schedule, making sure hundreds of thousands of Alaskans receive their funds smoothly. The big day many are looking forward to is August 21, 2025. This date is specifically for those whose applications are listed as “Eligible – Unpaid” as of August 13, 2025. It’s a good target date to keep in mind!

But payments don’t stop there. The PFD Division smartly has subsequent distribution dates for applications that move into that “Eligible – Unpaid” status later in the year. For instance, if your application is “Eligible – Unpaid” by September 3, 2025, your payment is set for September 11, 2025. Then, for those with that status by September 18, 2025, payments are scheduled for October 2, 2025. And finally, if your status updates by October 13, 2025, you can expect your distribution on October 23, 2025.

This phased approach means that even if you don’t receive your payment on the first wave, there are more opportunities just around the corner. You can receive your payment either through direct deposit, which is usually the quickest way, or by good old-fashioned paper check.

For residents eager to keep tabs on their payment, checking your application status is wonderfully straightforward. We highly recommend doing this regularly. You can easily monitor your application by heading over to the ‘myPFD’ section on the official PFD website: Check your application status via the myPFD portal. It’s a user-friendly portal that provides real-time updates, ensuring you’re in the loop every step of the way.

A New Yorker’s Perspective: How Alaska’s PFD Compares to Other State Programs

From our vantage point in New York City and across New York, the concept of the alaska permanent fund dividend stimulus payment is truly remarkable. While we’re accustomed to various state-level assistance programs, Alaska’s PFD stands out due to its universal nature and direct distribution of natural resource wealth. It prompts us to consider the diverse approaches states take to support their citizens and stimulate their economies.

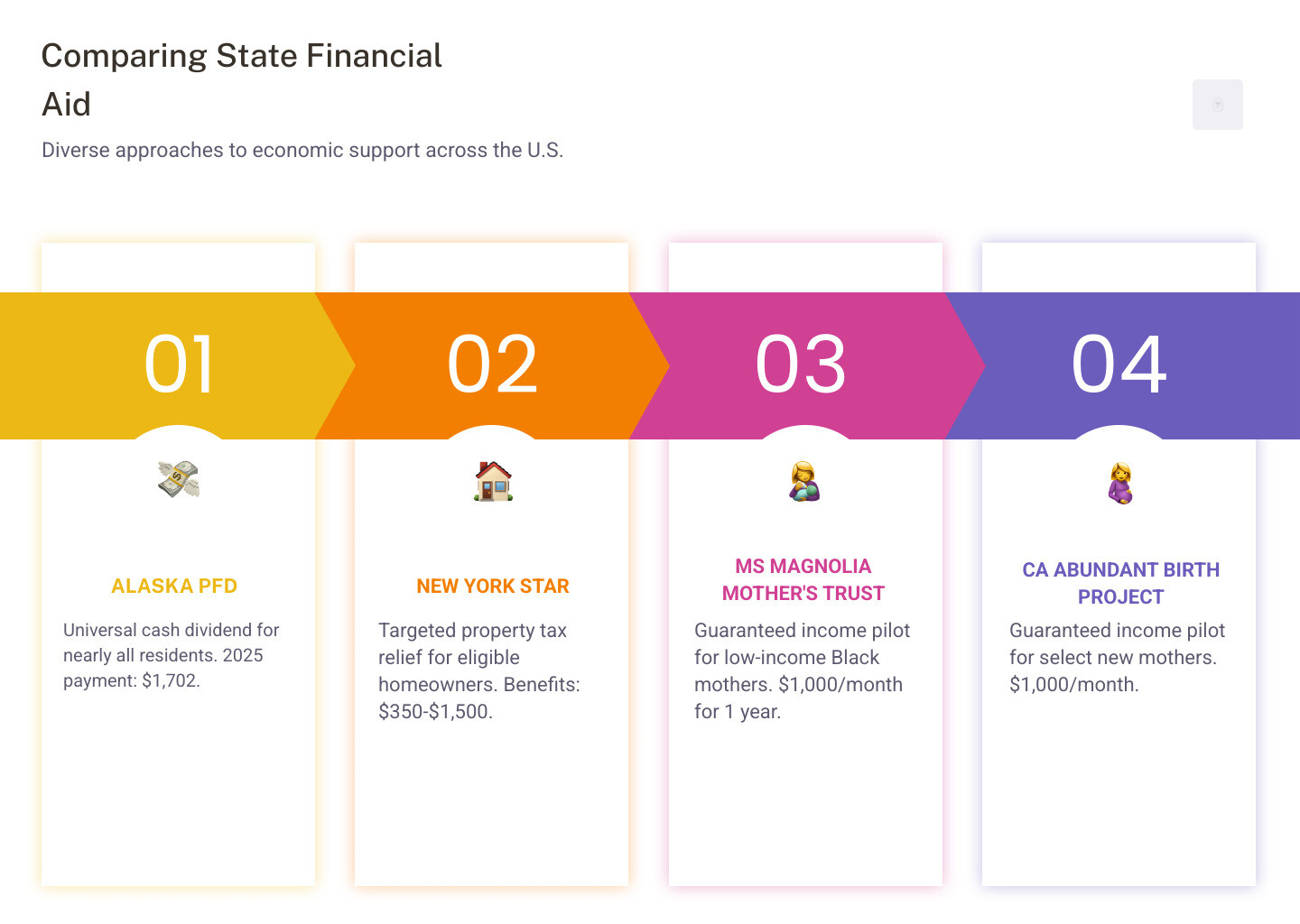

In many states, including ours, financial aid tends to be highly targeted. These programs are designed to address specific needs or demographics, such as low-income families, homeowners, or those facing particular hardships. Alaska’s PFD, on the other hand, is a universal payment to nearly all qualifying residents, regardless of their income or specific circumstances. It’s a fascinating contrast in economic support models.

New York’s STAR Program vs. Alaska’s PFD

Here in New York, one of the most prominent state-level relief programs is the School Tax Relief (STAR) Program. This initiative provides property tax relief to eligible homeowners on their primary residence. Governor Kathy Hochul has often highlighted how the STAR program helps put money back into New Yorkers’ pockets, aiming to ease the burden of school property taxes.

The STAR benefit can be received in one of two ways: either as an exemption that directly reduces your school tax bill, or as a credit issued in the form of a check or direct deposit. Eligibility for STAR is tied to homeownership and income levels, making it a targeted form of assistance. Most eligible homeowners receive between $350 and $600, while eligible seniors can receive between $700 and $1,500. It’s a significant help for many families, especially in areas with high property taxes like those surrounding New York City.

For more detailed information about the NY STAR program, you can visit: More on the NY STAR program.

When we compare this to Alaska’s PFD, the differences are stark. While STAR is a targeted property tax relief, the PFD is a universal cash payment to qualifying individuals. It’s not tied to property ownership or specific expenses like school taxes; it’s a direct dividend. This makes the alaska permanent fund dividend stimulus payment a unique economic experiment, providing broad-based support that directly injects funds into the hands of nearly all residents. It’s a “stimulus” in the purest sense, impacting consumer spending and local economies across the board.

Other Targeted State Initiatives

Beyond New York’s STAR program, other states have also explored various forms of financial assistance, often as pilot programs or in response to specific social challenges. These initiatives are typically much smaller in scope and more targeted than Alaska’s broad PFD.

Let’s look at a few examples:

| Program | State | Type of Assistance | Target Group | Payment Amount |

|---|---|---|---|---|

| Alaska Permanent Fund Dividend | Alaska | Universal Cash Payment | Nearly all qualifying residents | $1,702 (2025) |

| School Tax Relief (STAR) | New York | Property Tax Relief | Eligible Homeowners | $350-$1,500 (depending on eligibility) |

| Magnolia Mother’s Trust | Mississippi | Guaranteed Income Pilot | Low-income Black mothers | $1,000/month for 1 year |

| Abundant Birth Project | California | Guaranteed Income Pilot | Select new mothers | $1,000/month |

| Guaranteed Income for Artists | Minnesota | Guaranteed Income Pilot | Selected artists | $500/month |

Mississippi’s Magnolia Mother’s Trust, for instance, provides $1,000 monthly for one year to qualifying low-income families, specifically Black mothers. This program is designed to address systemic poverty and provide a stable financial foundation. You can learn more about it here: Mississippi’s Magnolia Mother’s Trust.

Similarly, California’s Abundant Birth Project delivers $1,000 monthly payments to select new mothers, aiming to improve maternal and infant health outcomes. Other states like Ohio, Michigan, and Illinois have also experimented with smaller guaranteed income programs, often focusing on single mothers or specific vulnerable populations. Minnesota even has a “Guaranteed Income for Artists” program, providing $500 monthly to 100 selected artists.

These programs, while vital for their intended recipients, underscore the unique position of the alaska permanent fund dividend stimulus payment. It’s not a temporary pilot, nor is it aimed at a specific demographic facing hardship. Instead, it’s a long-standing, universal distribution of shared wealth, a model that remains largely unparalleled in the United States.

The Economic Ripple Effect of Alaska’s Unique Dividend

From our vantage point in busy New York, where economic support often comes through targeted programs, the alaska permanent fund dividend stimulus payment stands out as a fascinating study in direct cash infusions. Imagine nearly a billion dollars flowing directly into people’s pockets each year – that’s the magic of the PFD. It’s not just a check in the mail; it’s a powerful economic force that creates a significant ripple effect benefiting everyone.

One of the most immediate and exciting impacts is on consumer spending. When hundreds of thousands of Alaskans receive their PFD, that money often finds its way right back into local businesses. People use it for everyday needs like groceries and household items, but also for bigger purchases, from new appliances to vehicles, or even those much-needed home repairs. This yearly surge in spending provides a reliable boost for local retailers, restaurants, and service providers, keeping cash circulating within the state’s economy. It’s truly a welcome annual injection that businesses can often anticipate and plan for.

Beyond immediate spending, the PFD plays a crucial role in reducing poverty rates and enhancing financial stability for countless families. It can be a real lifeline, easing financial stress and allowing residents to pay down debt, build up emergency savings, or invest in their future. For those on tighter budgets, the PFD can make all the difference, providing a bit of breathing room and helping them make ends meet. This added economic security often translates into better health and overall well-being for communities across Alaska.

The program also fosters a strong sense of economic opportunity. Knowing that an annual dividend is coming can empower individuals to take calculated risks, whether that’s starting a small business they’ve dreamed of or pursuing educational opportunities they might otherwise consider out of reach. It’s an underlying layer of financial support that truly underpins the Alaskan way of life.

Of course, like any large-scale economic program, there are always inflationary impact debates. Some folks wonder if injecting such a large sum into the economy each year could lead to rising prices. However, the consistent nature of the payment and how deeply integrated it is into Alaska’s economic fabric suggest that its broad benefits, in terms of direct relief and local economic stimulation, generally outweigh these concerns. It’s a fascinating and ongoing discussion, but one thing is clear: the PFD is a powerful engine for Alaska’s economy.

Frequently Asked Questions about the PFD

Living here in New York City, we get plenty of questions about Alaska’s unique dividend program from friends and colleagues who find the concept fascinating. The alaska permanent fund dividend stimulus payment is unlike anything we see in other states, so naturally, people want to understand how it really works. Let me share the most common questions we encounter and their answers.

Are PFD payments considered taxable income?

This question comes up constantly, and for good reason – nobody wants surprises at tax time. The short answer is yes, PFD payments are generally taxable income for federal tax purposes. When you receive your dividend, you’ll need to report it on your federal tax return.

But here’s where it gets interesting. The 2022 energy relief payment portion was actually deemed non-taxable by the IRS due to new guidance. So while the main dividend of $2,621.81 was taxable, that extra $662.19 energy relief payment wasn’t. This shows how components of the payment can be treated differently.

The good news for Alaskans? Since Alaska doesn’t have a state income tax, you won’t owe any state taxes on your alaska permanent fund dividend stimulus payment. That’s one less form to worry about.

Given how tax rules can change and vary based on individual circumstances, I always recommend consulting with a qualified tax professional. They can help you steer the specifics and ensure you’re handling everything correctly.

What are the future prospects for the PFD program?

This is probably the question that keeps Alaskans up at night. The program has been around since 1982, but like any long-term financial program, it faces ongoing challenges and debates.

Oil price fluctuations are the big wild card. Since the Permanent Fund originally gets its money from oil revenues, when oil prices tank, it affects the fund’s growth potential. We’ve seen how volatile energy markets can be, and Alaska feels those swings directly.

The political debates never really stop either. Legislators constantly wrestle with how much should be paid out versus how much should stay in the fund for future growth. Some want larger dividends now, others worry about sustainability. There have been various proposals to change the calculation formula over the years.

But here’s what gives me confidence in the program’s future: Alaskans absolutely love their PFD. Public opinion strongly supports keeping it going. It’s become such a fundamental part of life there that any politician who tried to eliminate it would face serious backlash.

While the exact amount might vary from year to year based on fund performance and legislative decisions, the core concept of sharing Alaska’s natural resource wealth with its people seems here to stay. It’s too ingrained in the state’s identity to disappear.

How can I update my information for the PFD?

Keeping your information current is crucial – you don’t want your payment going to an old address or getting stuck because of outdated banking details. Fortunately, Alaska has made this process pretty straightforward.

The myPFD portal is your best friend here. If you filed your application using a myAlaska account, you can make most changes directly online. This includes updating your mailing address, physical address, email, and direct deposit information. It’s user-friendly and much faster than dealing with paper forms.

For those who prefer the traditional route or didn’t use a myAlaska account, you can download and submit an Address Change form or Payment Method form by mail. Just remember that address and direct deposit changes can’t be handled over the phone – it has to be done online or through the mail for security reasons.

Timing matters here. If you want to guarantee your information is updated before the major payment distributions, you need to submit any changes by August 31, 2025. Missing this deadline could mean delays in receiving your alaska permanent fund dividend stimulus payment.

The official PFD website has everything you need: Update your details on the official PFD website. It’s worth bookmarking if you’re an Alaska resident – you’ll probably need it at some point.

Conclusion

So, there you have it! The alaska permanent fund dividend stimulus payment truly shines as a one-of-a-kind program in the U.S. It’s a brilliant example of how a state can share its natural wealth directly with its people, year after year.

Here in New York City, we often see aid that’s very specific, targeting certain needs. But Alaska’s universal dividend? That’s a fascinating twist! It’s a long-term plan for overall economic stability, not just a quick fix. It’s certainly a unique model of wealth distribution.

From our vantage point in New York, it’s truly eye-opening to compare these different ways of supporting citizens. Alaska’s PFD is a consistent financial boost. It helps people spend, supports local businesses, and connects Alaskans directly to their state’s resources. Yes, the payment amount might change, and there are always talks about its future. But the core idea of the PFD? That seems set in stone: sharing Alaska’s good fortune with those who call it home.

At R. Couri Hay Columns, we love digging into these kinds of stories. Whether we’re covering the glitz and glamour of a gala or the nitty-gritty details of economic policy, we aim to bring you fresh, engaging insights. The alaska permanent fund dividend stimulus payment is a perfect example of a unique story shaping our world.

Want to tell your own compelling story? See how we can help with branding and publicity. Just click here: Explore our branding and publicity services.