Why Nuclear Energy Stocks Are Capturing Wall Street’s Attention

Oklo stock (NYSE: OKLO) has become one of the most talked-about investments in the clean energy sector, with shares soaring over 850% in the past year. For investors seeking exposure to the next generation of nuclear power technology, Oklo represents both tremendous opportunity and significant risk.

Key Facts About Oklo Stock:

- Current Price: $78.47 (as of latest trading)

- Market Cap: $11.47 billion

- YTD Performance: +269.62%

- Business: Advanced fission power plants and nuclear fuel recycling

- Status: Pre-revenue company targeting 2027 for first revenue

- Key Technology: Aurora powerhouse (15-50 MWe output)

- Recent Rating: Hold (Craig-Hallum, UBS), citing regulatory uncertainties

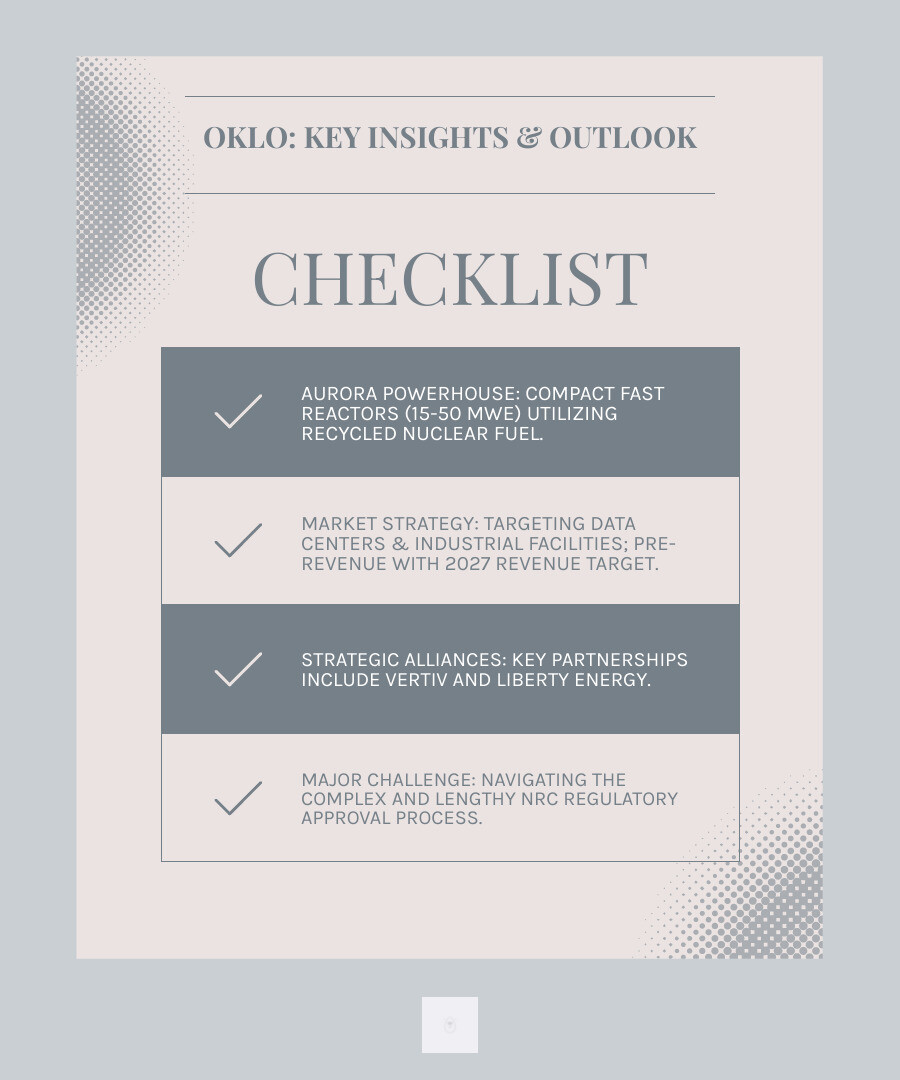

Oklo Inc., founded in 2013 by Jacob DeWitte and Caroline Cochran, is developing compact fast reactors designed to provide clean, reliable energy at scale. The company’s Aurora powerhouse technology aims to generate 15-50 megawatts of electricity using both recycled nuclear fuel and fresh fuel.

What makes this particularly relevant for sophisticated investors is the growing energy crisis facing major metropolitan areas. Here in New York City, where energy demands continue to surge alongside the AI boom and data center expansion, nuclear solutions like Oklo’s could play a crucial role in meeting future power needs.

The investment thesis centers on two key factors: the exploding energy demands from AI and data centers, and the potential for a “nuclear renaissance” in clean energy. However, analysts warn of an “uncharted regulatory path” with the Nuclear Regulatory Commission, making this a highly speculative play.

As R. Couri Hay, I’ve spent decades analyzing high-stakes investments and emerging technologies that capture the attention of New York’s elite circles. Having observed countless market trends from my vantage point in the city’s financial and social spheres, I recognize Oklo stock as emblematic of the type of bold, transformative bets that define this era of energy transition.

What is Oklo and What is its Business Model?

Oklo Inc., a company founded in 2013 by Jacob DeWitte and Caroline Cochran and based in Santa Clara, California, is not your average utility provider. Their core business revolves around advanced fission technology and nuclear fuel recycling. Essentially, they are designing and developing compact fast reactors to generate clean, reliable, and affordable energy. This isn’t just about building power plants; it’s about pioneering a new era of energy generation.

Their flagship product line is the Aurora powerhouse, a compact fast neutron reactor designed to produce between 15 and 50 megawatts of electrical power (MWe). What’s particularly innovative about Oklo’s approach is their intention to use both fresh and recycled nuclear fuel. This focus on fuel recycling could be a game-changer for the nuclear industry, addressing long-standing concerns about nuclear waste.

Oklo’s business model is quite straightforward in its ambition: they aim to sell power directly to customers. This contrasts with traditional large-scale nuclear plants that feed directly into the grid. Instead, Oklo envisions smaller, more agile power sources that can be deployed closer to demand centers. For those of us who appreciate strategic foresight in business, this direct-to-customer approach, particularly for specific energy-intensive clients, is a fascinating pivot. If you’re pondering the strategic planning behind such a bold venture, you might find our insights on strategic planning services illuminating.

The Technology Behind the Aurora Powerhouse

The Aurora powerhouse is not just a concept; it represents a tangible step towards a more sustainable energy future. These compact fast reactors are designed for efficiency, safety, and a smaller footprint compared to conventional nuclear plants. With an output ranging from 15 to 50 MWe, they are perfectly suited for powering specific facilities or communities, rather than an entire city. This modularity allows for greater flexibility and quicker deployment.

A key differentiator is their ability to operate on recycled nuclear fuel. This means taking spent fuel from existing reactors, reprocessing it, and using it to generate more power. It’s a closed-loop system that drastically reduces nuclear waste and improves fuel efficiency. This approach aligns perfectly with the growing demand for clean, reliable, and affordable energy at a commercial scale. For a deeper dive into their technological prowess, you can always visit Oklo Inc. designs and develops fission power plants.

Oklo’s Go-to-Market Strategy

Oklo’s strategy for bringing its power to market is focused and astute. They plan to enter into Power Purchase Agreements (PPAs) with customers, providing a stable revenue stream once their plants are operational. Their primary targets are emerging, energy-hungry sectors: data centers and industrial facilities. The increasing demand for computing power, especially with the rise of artificial intelligence, has created an urgent need for reliable, high-density energy sources. A Bloomberg article from May 2024 highlighted Oklo’s bullish outlook on data center energy needs, signaling a clear strategic direction.

While they are a global company in ambition, their initial focus is firmly on the U.S. market. This allows them to steer a single regulatory environment and build a strong domestic foundation before potentially expanding internationally.

A Deep Dive into Oklo Stock (OKLO) Financials and Performance

When we examine Oklo stock from a financial perspective, we’re looking at something quite extraordinary in today’s market. With a market capitalization of approximately $11.47 billion, Oklo Inc. (OKLO) sits firmly in large-cap territory. Yet here’s what makes this fascinating: the company is still completely pre-revenue.

That’s right – Oklo currently reports zero dollars in revenue and shows negative earnings per share of -5.40. Analysts don’t expect the company to generate its first dollar of revenue until 2027, with actual profitability potentially not arriving until 2030. This means the entire $11+ billion valuation rests on future potential, intellectual property, and market excitement rather than traditional financial metrics.

Despite the lack of revenue, Oklo’s balance sheet tells a reassuring story. The company maintains a robust cash position of $235.28 million and carries remarkably low debt with a debt-to-equity ratio of just 0.01%. This gives them a very healthy financial foundation to work from as they develop their technology. The levered free cash flow sits at -12.17 million, which is exactly what you’d expect from a company in heavy development mode.

Now, let’s talk about the stock performance – and boy, is it a wild ride. Oklo stock has delivered some truly eye-popping returns that would make even seasoned New York investors take notice. Over the past year, shares have surged an incredible 977.88%, absolutely crushing the SPY ETF’s modest 17.6% gain over the same period.

The shorter-term numbers are equally dramatic. Year-to-date performance shows a gain of 269.62%, while the six-month performance clocks in at an astounding 641.64%. Even recent performance has been volatile, with the stock showing a 15.22% gain in just one day and a remarkable 140.52% jump over five trading days.

This volatility becomes even clearer when you look at the 52-week trading range. Oklo stock has swung from a low of just $5.35 all the way up to $85.35 – that’s a range that would give any investor whiplash. The company’s beta ranges from 0.62 to 2.19 depending on the measurement period, indicating moderate to high sensitivity to broader market movements.

Current Analyst Ratings and Price Targets for oklo stock

The analyst community remains divided on Oklo stock, much like art critics reviewing a provocative new exhibition at a Manhattan gallery – everyone has strong opinions, but the final verdict is still out.

UBS recently initiated coverage with a “Neutral” rating and set a price target of $65. While they acknowledge the potential for what they call a “nuclear renaissance,” they remain cautiously optimistic. Their main concern? It’s incredibly difficult to value a company with no current revenue, earnings, or free cash flow.

Craig-Hallum took a more bearish stance, downgrading Oklo to “Hold” from “Buy” on June 23, 2025. Their reasoning centers on what they describe as an “uncharted regulatory path” – essentially highlighting the massive regulatory problems Oklo still faces with the Nuclear Regulatory Commission.

On the flip side, Wedbush maintains a more bullish outlook. They raised their price target to $75 from $55 on June 12, 2025, while keeping their “Buy” rating intact. This suggests they believe Oklo can successfully steer its challenges and capitalize on the growing energy demands we’re seeing here in places like New York City.

The recurring theme across all analyst reports is the uncharted regulatory path. This phrase keeps appearing because Oklo is pioneering technology that regulators haven’t fully evaluated before. It’s both the company’s biggest opportunity and its greatest risk.

Historical Performance and Key Trends for oklo stock

Oklo’s public market journey began on July 8, 2021, when the company went public. Since then, the stock has been nothing short of a roller coaster ride that would rival any thrill ride at Coney Island.

The company hit its all-time high closing price of $84.09 on August 5, 2025 – a stark contrast to its 52-week low of $5.35. This massive swing perfectly captures the speculative nature of this investment.

Looking at annual performance trends reveals just how dramatically things have accelerated. In 2022 and 2023, Oklo stock posted modest gains of 0.71% and 6.45% respectively. But 2024 brought a 101.04% annual gain, and 2025 has already delivered a staggering 254.78% return as of August.

This acceleration coincides with growing interest in clean energy solutions, the AI boom driving energy demand, and increasing recognition of small modular reactors as a viable technology. For those of us watching from New York’s financial district, it’s clear that institutional interest has grown substantially.

Recent stock offerings have added another layer to the story. Oklo offered $400 million in common stock on June 11, 2025, and completed a $440.6 million stock offering on June 16, 2025. While these offerings provide crucial capital for development, they also create share dilution. This typically puts short-term pressure on stock prices, as we saw when Oklo stock dropped 6% following the June equity offering announcement.

The company’s outperformance compared to broader markets has been remarkable. While the SPY ETF gained a respectable 17.6% over the past year, Oklo stock delivered that 977.88% return. Even in shorter three-month periods, Oklo’s 89.9% gain dwarfed SPY’s 9.3% performance. However, this outperformance comes with significant volatility – some two-week periods have seen Oklo actually underperform the broader market, reminding investors of the wild swings inherent in this investment.

Key Catalysts and Headwinds for Oklo’s Future

The trajectory of Oklo stock depends on several powerful forces that could either propel it to new heights or create significant obstacles. Understanding these dynamics is crucial for anyone considering this high-stakes investment.

The most compelling catalyst driving Oklo’s future is the AI boom and its insatiable appetite for energy. As artificial intelligence models become increasingly sophisticated, data centers are consuming unprecedented amounts of power. Here in New York City, where tech companies are expanding rapidly, this energy crunch is becoming a real concern for businesses and policymakers alike.

Oklo has positioned itself brilliantly to capitalize on this trend. Their compact nuclear reactors could provide the reliable, clean power that data centers desperately need. Unlike solar or wind power, which can be intermittent, nuclear energy provides consistent output around the clock – exactly what AI operations require.

The company isn’t just talking about this opportunity; they’re actively pursuing it through strategic partnerships. Their collaboration with Vertiv focuses specifically on developing power and cooling solutions for hyperscale and colocation data centers. Meanwhile, their partnership with Liberty Energy targets broader industrial facilities that need reliable power sources.

Government contracts represent another major catalyst. When news broke of Oklo’s U.S. Air Force contract on June 11, 2025, Oklo stock jumped 10% in a single day. This kind of government endorsement validates their technology and opens doors to additional federal opportunities.

The broader nuclear sector outlook is increasingly positive. We’re witnessing what many experts call a “nuclear renaissance,” driven by climate goals and energy security concerns. Even New York state is planning its first new reactor in 15 years, signaling a shift in public and political sentiment toward nuclear power. The Department of Energy is actively supporting reactor development, and NASA is even planning to deploy nuclear reactors in space – all contributing to a favorable industry environment.

As someone who’s observed countless investment trends from my perch in New York’s financial circles, I find the convergence of AI demand and nuclear innovation particularly compelling. The branding services we provide often help companies steer such transformative moments, and Oklo’s positioning strikes me as strategically sound.

You can read more about this growing opportunity in this Altman-Backed Nuclear Firm Bullish on Data Center Need article.

Major Risks and Regulatory Problems

However, every compelling investment story has its challenges, and Oklo faces some significant headwinds. The Nuclear Regulatory Commission (NRC) represents the company’s biggest obstacle. Nuclear energy is one of the most heavily regulated industries in the world, and for good reason.

The licensing process is complex, lengthy, and unpredictable. Craig-Hallum’s recent downgrade to “Hold” specifically cited this “uncharted regulatory path” as their primary concern. While Oklo has made progress by completing an NRC Readiness Assessment, the journey to full commercial operation remains long and uncertain.

Any delays or setbacks in regulatory approval could dramatically impact Oklo’s commercialization timeline. This is a pre-revenue company that needs to start generating income to justify its current $11.47 billion valuation. Every month of delay pushes that revenue further into the future.

The company also faces competition from other energy sources. While nuclear has unique advantages, solar and wind power continue to become cheaper and more efficient. Battery storage technology is also advancing rapidly, potentially reducing the need for always-on power sources like nuclear reactors.

Insider Activity and Institutional Ownership

The insider dynamics at Oklo tell an interesting story. Sam Altman’s involvement has been both a blessing and a complication. His departure from the board in April 2025 was strategic – designed to avoid conflicts of interest ahead of potential energy deals between his other ventures and Oklo. This suggests future business opportunities but also highlights the complex relationships involved.

Recent insider sales have raised some eyebrows among investors. CEO Jacob DeWitte and COO Caroline Cochran made notable stock sales in late June 2025, including a significant $15.8 million sale by a director. While these transactions might simply reflect personal financial planning, they’re always scrutinized for what they might signal about management’s confidence.

Institutional ownership stands at approximately 29.50%, while insider ownership is around 28.36%. These are healthy levels that suggest both professional investors and company leadership have skin in the game.

The short interest of 15.57 million shares (14.87% of the float) indicates significant skepticism from some market participants. This high level of short selling can create volatility, as positive news can trigger short squeezes that drive prices up rapidly.

From my years of analyzing high-profile investments and the personalities behind them, I see Oklo as embodying both the promise and perils of transformative technology. The regulatory path may be uncharted, but for investors willing to take calculated risks on the future of clean energy, Oklo stock represents one of the most intriguing opportunities in today’s market.

Frequently Asked Questions about Oklo

When it comes to Oklo stock, I find myself fielding the same questions repeatedly at dinner parties and social gatherings here in Manhattan. Given the company’s unique position and the buzz surrounding nuclear energy investments, it’s natural that sophisticated investors want straight answers. Let me address the most common concerns I encounter.

Is Oklo generating revenue?

This is perhaps the most important question to understand before investing. Oklo is currently a pre-revenue company, which means they’re not making any money from their core business yet. Their Aurora powerhouses simply aren’t operational.

Think of it this way: Oklo is like a brilliant chef who has developed an incredible recipe but hasn’t opened their restaurant yet. The business model revolves entirely around future energy sales from power plants that are still in development. Right now, the company’s $11.47 billion valuation is based purely on its technology, intellectual property, and future market potential rather than actual earnings.

Most analysts project that Oklo won’t start generating revenue until around 2027. Until then, investors are essentially betting on the company’s ability to execute its ambitious plans and steer the regulatory maze ahead.

Why is Oklo stock so volatile?

If you’ve been watching Oklo stock, you’ve probably noticed it moves like a roller coaster. With gains of over 850% in the past year and daily swings that can exceed 15%, this isn’t your typical utility stock.

The volatility stems from several factors that are common among pre-revenue companies in highly regulated industries. Every piece of news hits this stock like a lightning bolt. When Oklo announced a U.S. Air Force contract in June 2025, shares jumped 10% in a single day. Conversely, when Craig-Hallum downgraded the stock citing regulatory uncertainties, it created significant selling pressure.

Regulatory updates from the NRC, partnership announcements, analyst rating changes, and broader market sentiment toward nuclear energy all create massive price swings. The high short interest of nearly 16% also amplifies volatility, as short squeezes can occur when positive news forces bearish investors to cover their positions rapidly.

For those of us in New York’s investment circles who are accustomed to more stable blue-chip stocks, Oklo’s price action can be jarring. It’s definitely not for the faint of heart.

What is the biggest challenge facing Oklo?

Without question, navigating the complex regulatory approval process with the U.S. Nuclear Regulatory Commission represents Oklo’s greatest hurdle. This isn’t just another business challenge – it’s the make-or-break moment for the entire company.

The nuclear industry operates under some of the most rigorous safety regulations in the world, and for good reason. Successfully obtaining a license to build and operate its first commercial Aurora powerhouse is absolutely critical for Oklo’s future. Any delays in this process could push back commercialization timelines by years, dramatically impacting investor confidence and financial projections.

Craig-Hallum’s recent downgrade specifically cited this “uncharted regulatory path” as their primary concern. While Oklo has made progress with the completion of an NRC Readiness Assessment, the journey from development-stage company to revenue-generating power provider remains long and uncertain.

Until Oklo clears this regulatory hurdle, everything else – the partnerships, the technology, the market opportunity – remains theoretical. It’s the ultimate gatekeeper between Oklo’s current status and its future success.

Conclusion

When I look at Oklo stock from my perch here in New York City, I see a company that perfectly captures the spirit of our times – bold, ambitious, and slightly unpredictable. This is the kind of high-risk, high-reward investment that gets talked about at Manhattan dinner parties and boardrooms alike.

The numbers tell quite a story. With shares up over 850% in the past year, Oklo stock has delivered the kind of returns that make even seasoned Wall Street veterans take notice. But let’s be honest about what we’re dealing with here – this is a pre-revenue company betting everything on a technology that hasn’t been fully proven in the commercial market yet.

The potential upside is enormous. The AI boom has created an energy crisis that traditional power sources simply can’t solve fast enough. Here in New York, where our energy grid is constantly strained, the idea of compact nuclear reactors providing clean, reliable power is genuinely exciting. Oklo’s Aurora powerhouses could be exactly what data centers and industrial facilities need.

Their strategic partnerships with companies like Vertiv and Liberty Energy show they’re serious about capturing this market. The U.S. Air Force contract proves the government sees value in their technology. Even the plans for New York’s first new reactor in 15 years suggest we’re entering a nuclear renaissance that could benefit companies like Oklo tremendously.

But here’s where it gets tricky. The Nuclear Regulatory Commission doesn’t move fast, and they don’t take shortcuts. That “uncharted regulatory path” that analysts keep mentioning? It’s real, and it’s the biggest obstacle standing between Oklo and success. Any delays could push their revenue timeline well beyond 2027, and in a market this volatile, patience isn’t always rewarded.

The insider sales by CEO Jacob DeWitte and other executives raise eyebrows too. While these might be routine financial planning, they don’t exactly scream confidence when you’re asking investors to bet on a decade-long timeline.

For investors with deep pockets and longer horizons, Oklo stock represents a fascinating speculation on the future of clean energy. The growing demand for reliable power in major metropolitan areas like ours isn’t going away. If anything, it’s accelerating.

As someone who’s spent years observing the intersection of technology, finance, and society from New York’s unique vantage point, I find Oklo emblematic of our current moment – full of promise but requiring a strong stomach for uncertainty. The company could revolutionize how we think about nuclear power, or it could become another cautionary tale about regulatory complexity.

The choice, as always, comes down to your risk tolerance and belief in transformative technology. For more insights into the forces shaping our energy future and the stories that matter to New York’s discerning readers, explore our publicity services.